The Only Guide to Mileagewise - Reconstructing Mileage Logs

Table of ContentsMileagewise - Reconstructing Mileage Logs Can Be Fun For Everyone6 Simple Techniques For Mileagewise - Reconstructing Mileage LogsRumored Buzz on Mileagewise - Reconstructing Mileage LogsLittle Known Questions About Mileagewise - Reconstructing Mileage Logs.The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is DiscussingLittle Known Questions About Mileagewise - Reconstructing Mileage Logs.

Large Sibling. People living in the 21st century deal with an unmatched awareness of means they can be checked by powerful companies. No one wants their boss added to that checklist.

In order to recognize the benefits of general practitioner mileage logs without driving employees out the door, it is very important to pick a proper general practitioner application and institute guidelines for proper use. Motorists need to be able to edit journeys and mark specific parts as individual to make sure that no information concerning these journeys will be sent to the employer.

The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

Vehicle drivers need to also be able to shut off the app if necessary. Even if you have information on your staff members' location during service traveling doesn't imply you have to have a conversation regarding every information - mileage log for taxes. The key objective of the GPS app is to offer precise mileage tracking for reimbursement and tax obligation functions

It is typical for a lot of organizations to monitor staff members' usage of the net on business devices. The easy fact of checking inhibits unsuccessful web use without any type of micromanagement.

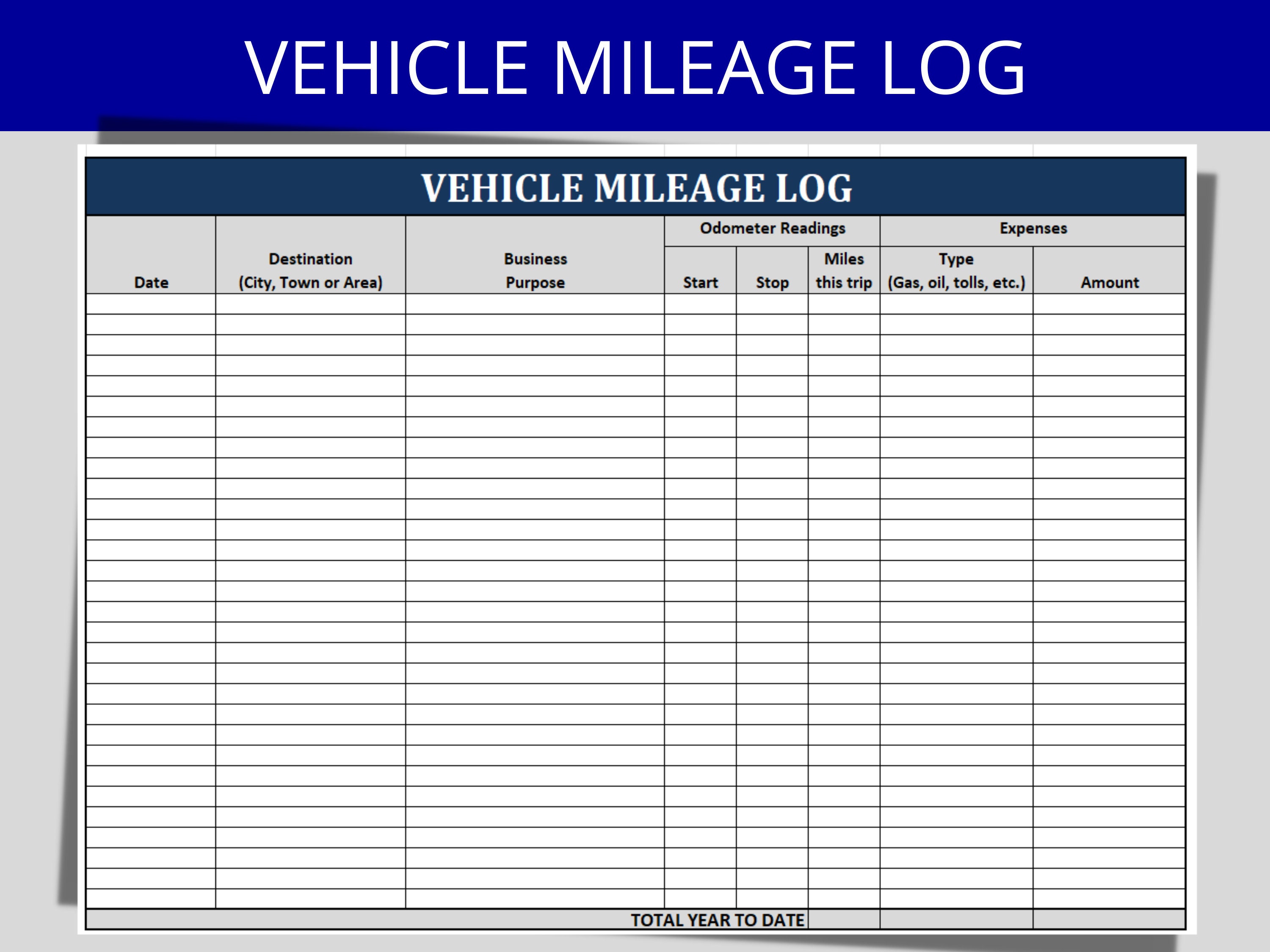

There's no denying there are several benefits to tracking gas mileage for organization. Yet, there's also no sugar-coating that it can take up a fair bit of time to do so manually. We obtain it as a local business owner, you already have a continuous to-do list. Unless you're tracking mileage for settlement objectives, working out exactly how to track mileage for work trips may not feel like a high-priority job.

The Mileagewise - Reconstructing Mileage Logs Statements

In addition to maximizing your tax obligation reductions by giving trip information and timestamps with determine accuracy, you can remove detours and unapproved individual trips to improve staff member liability and performance. Looking for a detailed option to aid handle your service expenditures?

Have you experienced the pain of going over business trips carefully? The overall miles you drove, the gas costs with n variety of other expenses., once more and again. On standard, it takes practically 20 hours each year for a single individual to visit their mile logs and other prices.

Top Guidelines Of Mileagewise - Reconstructing Mileage Logs

Currently comes the main picture, tax obligation deduction with gas mileage tracker is the broach the area. Declaring a tax obligation deduction for company has never been easier than currently. All you need to do is pick in between the methods that pay you a lot more. In information listed below, we have actually clarified the two means by which you can assert tax obligation- deduction for business miles travelled.

For your convenience, we have actually created the checklist of requirements to be thought about while choosing the best mileage tracking application. Automation being an essential consider any business, make certain to pick one that has automated types which can determine expenses quickly. Constantly search for additional functions used, such as the amount of time one has actually functioned as in the most recent apps.

Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

The data is constantly available to you on your smartphone to review, revise and edit any time. These applications are user-friendly and very easy to use. They aid you save time by determining your gas mileage and keeping a document of your data. Therefore, Gas mileage tracker apps like Simply Vehicle help not just preserving the mile logs yet also with the compensation of service miles.

All About Mileagewise - Reconstructing Mileage Logs

government company liable for the collection of taxes and enforcement of tax regulations. Developed in 1862 by President Abraham Lincoln, the agency regulates under the authority of the USA Division of the Treasury, with its primary purpose comprising the collection of individual revenue taxes and work tax obligations.

Apple iphone: 4.8/ Google Play: 3.5 Stride is a totally free mileage and expense-tracking app that collaborates with Stride's other services, like medical insurance and tax-prep assistance. Along with offering websites to Stride's various other products, it uses a gas mileage and expense-tracking function. I had the ability to download and install and set up the app quickly and promptly with both my apple iphone and a Galaxy Android tablet.

While the costs app supplies to link to your financial institution or credit accounts to streamline expensing, it won't link to your Uber/Lyft accounts. My (minimal) screening of Everlance revealed very similar gas mileages to Google Maps, so accuracy ought to get on par with the remainder of the apps. mileage tracker. Generally, I assumed Everlance was well-executed and simple to utilize, but the attributes of the totally free and even premium versions just didn't come up to a few of the other apps'

Comments on “What Does Mileagewise - Reconstructing Mileage Logs Do?”